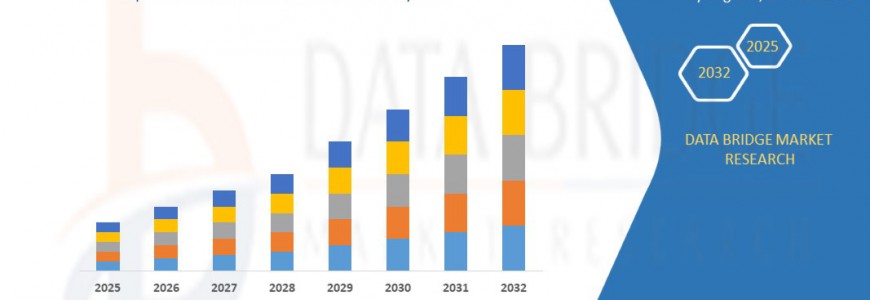

The global digital twin financial services and insurance market size was valued at USD 5.67 billion in 2024 and is expected to reach USD 19.00 billion by 2032, at a CAGR of 16.30% during the forecast period

Latest Insights on Executive Summary Digital Twin Financial Services and Insurance Market Share and SizeCAGR Value

The global digital twin financial services and insurance market size was valued at USD 5.67 billion in 2024 and is expected to reach USD 19.00 billion by 2032, at a CAGR of 16.30% during the forecast period

The Digital Twin Financial Services and Insurance Market report is the best to know the trends and opportunities in Digital Twin Financial Services and Insurance Market The forecast, analysis, evaluations, and estimations carried out in this Digital Twin Financial Services and Insurance report are all based upon the well-established tools and techniques such as SWOT analysis and Porter’s Five Forces analysis. These are the authentic tools used in market analysis on which businesses can trust confidently. This Digital Twin Financial Services and Insurance Market report brings into focus a plentiful number of factors, such as the general market conditions, trends, inclinations, key players, opportunities, and geographical analysis, which all aid in taking your business towards growth and success.

This Digital Twin Financial Services and Insurance Market report also estimates the growth rate and the market value based on market dynamics and growth inducing factors. It is a well-versed fact that competitive analysis is the major aspect of any market research report and hence many points are covered under this, including strategic profiling of key players in the market, analyse core competencies of key players, and drawing a competitive landscape for the market. This global Digital Twin Financial Services and Insurance business report has been built with the careful efforts of an innovative, enthusiastic, knowledgeable, and experienced team of analysts, researchers, industry experts, and forecasters.

Dive into the future of the Digital Twin Financial Services and Insurance Market with our comprehensive analysis. Download now:

https://www.databridgemarketresearch.com/reports/global-digital-twin-financial-services-and-insurance-market

Digital Twin Financial Services and Insurance Business Outlook

Segments

- Type: The digital twin market in the financial services and insurance sector is segmented by type into Parts Twin, Product Twin, Process Twin, and System Twin. Parts twin includes the digital representation of physical parts or assets within the financial institution or insurance company. Product twin focuses on creating digital replicas of the products offered within the sector. Process twin involves the digital representation of the operations and processes within the organization. System twin refers to the overall system or ecosystem of the financial services or insurance industry.

- Application: The market is further segmented by application into Predictive Maintenance, Performance Monitoring, Inventory Management, Business Process Optimization, and Others. Predictive maintenance helps in forecasting maintenance requirements for assets using digital twin technology. Performance monitoring involves tracking and analyzing the performance of products and processes. Inventory management focuses on managing and optimizing inventory levels using digital twins. Business process optimization aims to enhance operational efficiency and streamline processes within financial services and insurance companies.

- Deployment: Deployment segments include Cloud-Based and On-Premises. Cloud-based deployment offers scalability, flexibility, and cost-effectiveness for financial institutions and insurance providers. On-premises deployment provides greater control and customization options but may require higher upfront investment and maintenance costs.

Market Players

- Siemens: Siemens offers digital twin solutions for the financial services and insurance industry, enabling real-time monitoring, predictive analytics, and risk management capabilities.

- IBM: IBM provides digital twin technology for financial institutions and insurance companies to enhance operational efficiency, customer experience, and risk management practices.

- Oracle: Oracle offers digital twin solutions that help financial services and insurance organizations optimize processes, improve decision-making, and drive innovation.

- Accenture: Accenture provides digital twin consulting services to help financial institutions and insurance providers harness the power of digital twins for business transformation and competitive advantage.

- Cisco: Cisco offers digital twin solutions for the financial services and insurance sector to enable secure data sharing, predictive maintenance, and personalized customer experiences.

The global digital twin financial services and insurance market is expected to witness significant growth due to the increasing adoption of digital technologies, the rising demand for predictive analytics and real-time monitoring solutions, and the growing focus on improving operational efficiency and customer experience within the sector.

The digital twin market in the financial services and insurance sector continues to expand as organizations leverage advanced technologies to enhance their operations and services. One emerging trend within this market is the increasing focus on utilizing digital twins for risk management and regulatory compliance. By creating digital replicas of assets, products, and processes, financial institutions and insurance companies are better equipped to assess and mitigate risks, comply with industry regulations, and enhance their overall governance practices. This shift towards leveraging digital twins for risk management is driven by the need to proactively identify and address potential vulnerabilities in operations, products, and services, thus safeguarding against financial losses and reputational damage.

Another key development in the digital twin market for financial services and insurance is the integration of artificial intelligence (AI) and machine learning algorithms into digital twin solutions. By incorporating AI-driven analytics, organizations can gain deeper insights from the data collected by digital twins, enabling more accurate predictions, proactive maintenance strategies, and personalized customer experiences. This fusion of digital twin technology with AI capabilities is empowering financial institutions and insurance providers to optimize their decision-making processes, automate routine tasks, and deliver targeted solutions tailored to individual customer needs.

Moreover, the adoption of digital twins in the financial services and insurance sector is reshaping traditional business models and driving innovation across various segments. For instance, the utilization of digital twins in predictive maintenance applications is revolutionizing asset management practices by enabling predictive and condition-based maintenance strategies. This proactive approach to maintenance not only minimizes downtime and reduces operational costs but also enhances asset performance and longevity. Similarly, the implementation of digital twins for inventory management is optimizing supply chain operations, improving resource utilization, and streamlining inventory replenishment processes.

Furthermore, the deployment of cloud-based digital twin solutions is gaining traction in the financial services and insurance industry, offering organizations greater agility, scalability, and cost efficiencies. Cloud-based deployment models provide easy access to real-time data, seamless integration with existing systems, and enhanced collaboration capabilities, facilitating faster decision-making and improved operational agility. In contrast, on-premises deployment options offer organizations greater control over their data and security protocols, catering to specific compliance requirements and data governance policies within the sector.

In conclusion, the digital twin market in the financial services and insurance industry is poised for exponential growth, driven by the convergence of digital technologies, the adoption of AI-driven analytics, and the pursuit of operational excellence and customer-centricity. As organizations continue to embrace digital transformation initiatives, the integration of digital twins into their business processes and decision-making frameworks will play a pivotal role in shaping the future landscape of the industry, fostering innovation, and driving sustainable growth.Digital twin technology is transforming the financial services and insurance sector by offering innovative solutions for operational efficiency, risk management, and customer experience enhancement. One notable trend shaping the market is the increasing focus on leveraging digital twins for risk management and regulatory compliance. By creating digital replicas of assets, products, and processes, organizations can proactively identify and mitigate risks, ensure regulatory adherence, and strengthen governance practices. This trend underscores the importance of utilizing advanced technologies to enhance decision-making processes and safeguard against potential financial losses and reputational damage.

Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms into digital twin solutions is a key development driving market evolution. AI-driven analytics enable organizations to extract valuable insights from the data generated by digital twins, facilitating more accurate predictions, proactive maintenance strategies, and personalized customer experiences. This fusion of digital twin technology with AI capabilities empowers financial institutions and insurance providers to optimize their operations, automate tasks, and deliver tailored solutions to meet the evolving needs of their customers.

Moreover, the adoption of digital twins across various segments of the financial services and insurance industry is catalyzing business model transformation and fostering innovation. For instance, the implementation of digital twins in predictive maintenance applications is revolutionizing asset management practices by enabling predictive maintenance strategies, reducing downtime, and enhancing asset performance. Similarly, the use of digital twins in inventory management is optimizing supply chain operations, improving resource utilization, and streamlining inventory replenishment processes.

Another noteworthy trend in the market is the increasing popularity of cloud-based deployment models for digital twin solutions. Cloud deployment offers organizations agility, scalability, cost efficiency, real-time data access, seamless integration, and enhanced collaboration capabilities. On the other hand, on-premises deployment options provide greater control over data and security protocols, catering to compliance requirements and data governance policies in the sector.

In conclusion, the digital twin market in the financial services and insurance industry is poised for substantial growth, driven by technological advancements, AI integration, and the pursuit of operational excellence. The increasing adoption of digital twin solutions is reshaping business practices, enhancing risk management capabilities, and improving customer experiences. As organizations continue to embrace digital transformation initiatives, the utilization of digital twins will play a pivotal role in driving innovation, fostering sustainable growth, and reshaping the future landscape of the industry.

Analyze detailed figures on the company’s market share

https://www.databridgemarketresearch.com/reports/global-digital-twin-financial-services-and-insurance-market/companies

Digital Twin Financial Services and Insurance Market – Analyst-Ready Question Batches

What is the current demand volume of the Digital Twin Financial Services and Insurance Market?

How is the market for Digital Twin Financial Services and Insurance expected to evolve in the next decade?

What segmentation criteria are applied in the Digital Twin Financial Services and Insurance Market study?

Which players have the highest market share in the Digital Twin Financial Services and Insurance Market?

What regions are assessed in the country-level analysisfor Digital Twin Financial Services and Insurance Market?

Who are the top-performing companies in the Digital Twin Financial Services and Insurance Market?

Browse More Reports:

Global High-Temperature Sterilization Equipment Market

Global Hybrid Content Intelligence Market

Global Hypertriglyceridemia Market

Global Infant Incubator Market

Global International Standards Organisation (ISO) Shipping Container Market

Global Intrinsically Safe Equipment Market

Global Kinase Inhibitors Market

Global Laminating Adhesives Market

Global Light Commercial Truck Market

Global Light Field Market

Global Liquid Ethylene Carbonate Market

Global Liver Panel Testing Market

Global Lubricant Additives Market

Global Lujo Hemorrhagic Fever (LUHF) Treatment Market

Global Maffucci Syndrome Treatment Market

Global Micro Perforated Films for Packaging Market

Global Nasal Spray Packaging Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [javascript protected email address]

kshdbmr

kshdbmr

ravindrankhx

ravindrankhx jr6732484

jr6732484